Introduction

In the dynamic world of investments, the Indian market presents a unique landscape with its blend of traditional and modern investment options. Diversifying your investment portfolio is a crucial strategy for managing risk and optimizing returns. This blog delves into portfolio diversification strategies tailored for the Indian market, offering insights for both novice and seasoned investors.

Understanding Portfolio Diversification

Portfolio diversification is the practice of spreading your investments across various asset classes to reduce risk. The adage “don’t put all your eggs in one basket” perfectly encapsulates this concept. Diversification can protect your portfolio from market volatility and unforeseen economic changes.

Asset Classes in India:

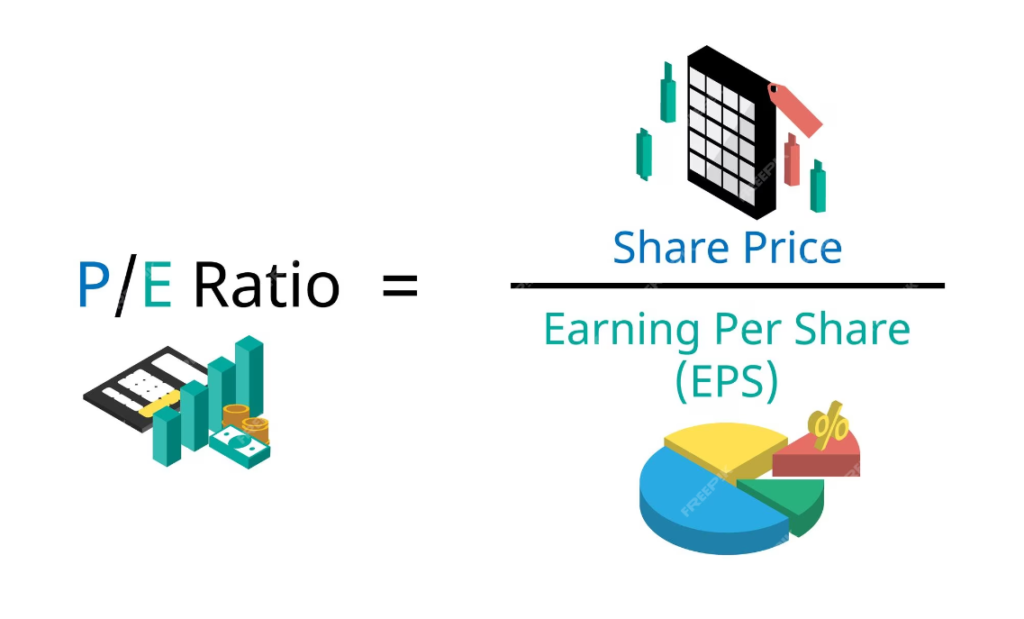

- Equity: Investing in stocks of companies listed on Indian stock exchanges like BSE and NSE.

- Debt: Including government bonds, corporate bonds, and fixed deposits.

- Real Estate: Investment in property, either residential or commercial.

- Gold: Traditional and popular, especially in the form of jewelry or gold ETFs.

- Mutual Funds: Offering a mix of equity and debt, managed by professionals.

- Alternative Investments: Including private equity, venture capital, and cryptocurrencies.

Strategies for Diversifying Your Portfolio

1. Assess Your Risk Tolerance

Understanding your risk appetite is crucial. Younger investors might prefer equity for long-term growth, while older investors might lean towards debt for stability.

2. Geographic Diversification

Invest not only in Indian markets but also in international stocks and funds, to mitigate country-specific risks.

3. Sectoral Diversification

Invest across different sectors like IT, healthcare, FMCG, and manufacturing, to cushion against sector-specific downturns.

4. Regular Rebalancing

Regularly review and rebalance your portfolio to maintain the desired risk level, especially after significant market movements.

5. Use of Index Funds and ETFs

Index funds and ETFs can provide broad market exposure with lower risk than individual stocks.

Benefits of Diversification in the Indian Context

- Mitigates Risk: Diversification helps in reducing the impact of a single asset’s poor performance on the overall portfolio.

- Steady Returns: A well-diversified portfolio tends to yield more consistent returns over time.

- Capitalizes on Market Opportunities: Exposure to various asset classes allows investors to capitalize on different market trends.

Case Studies

- High-Risk Portfolio: A young investor’s portfolio with a higher proportion of equities and alternative investments.

- Balanced Portfolio: A mix of equities, debt, and gold, suitable for mid-age investors.

- Conservative Portfolio: Dominated by debt and fixed-income instruments, ideal for retirees.

Conclusion

Diversifying your investment portfolio in the Indian market is essential for balancing risk and return. It’s important to continuously educate oneself and possibly consult with financial advisors to keep abreast of market changes and opportunities.